The quarterly earnings season is a crucial time for market watchers, investors, and economists alike. Analyzing the financial results of major Nifty 50 companies not only provides insights into individual company performance but also helps gauge the broader economic landscape and predict potential market trends. This article covers highlights from recent quarterly earnings reports and identifies key stocks on the Nifty 50 index to watch based on their financial performance, sector outlook, and growth potential.

Overview of Nifty 50’s Quarterly Performance

The Nifty 50 index comprises the top-performing companies in various sectors across India, representing the economic pulse of the nation. Recent quarterly results indicate a mix of strong earnings in some sectors, tempered growth in others, and specific trends influenced by global economic factors like inflation, interest rates, and commodity prices. Investors should pay particular attention to companies demonstrating resilience and strong fundamentals in this environment.

Key Highlights from Recent Quarterly Earnings

1. Reliance Industries (RIL)

Performance Overview: Reliance Industries, a major player in the energy, telecom, and retail sectors, reported solid revenue growth this quarter, driven primarily by its telecom and retail businesses, with refining margins contributing positively.

Impact on Nifty 50: Reliance’s diversified portfolio positions it as a stable anchor within Nifty 50. Continued growth in Jio (telecom) and Reliance Retail is expected to drive stock performance, even as energy markets remain volatile.

Stock Watch Insight: Investors see Reliance as a relatively safe investment due to its diversified revenue streams. Analysts project stable long-term growth, particularly in digital and retail ventures.

For more on Reliance’s growth strategy, visit our In-Depth Analysis of India’s Top Conglomerates.

2. HDFC Bank

Performance Overview: HDFC Bank, one of India’s leading private banks, posted robust net interest income (NII) growth, driven by an increase in retail lending and favorable net interest margins (NIM). However, higher provisions impacted net profit slightly.

Impact on Nifty 50: As a major component of the financial sector, HDFC Bank’s earnings indicate steady demand in retail and corporate lending, despite inflationary pressures. Its conservative risk management and stable asset quality contribute to overall Nifty 50 stability.

Stock Watch Insight: Analysts remain optimistic, viewing HDFC Bank as a strong defensive play with the potential for steady returns, especially in a volatile interest rate environment.

3. Infosys

Performance Overview: Infosys reported moderate revenue growth, but its guidance was revised downward due to a slowdown in global IT spending. Key growth areas include cloud services and digital transformation projects, although currency fluctuations have impacted margins.

Impact on Nifty 50: As a major IT services exporter, Infosys reflects global IT sector trends. Lowered guidance may affect investor sentiment on the IT sector, influencing sectoral index performance.

Stock Watch Insight: Long-term prospects remain positive, especially in digital services, but short-term growth may face pressure. Investors should watch for updates on global IT spending trends.

For a broader view on the Indian IT sector, see our Technology Sector Outlook 2024.

4. Tata Motors

Performance Overview: Tata Motors recorded strong revenue growth this quarter, thanks to increased demand in the electric vehicle (EV) and passenger vehicle segments. Jaguar Land Rover (JLR) also reported improved performance, boosted by a recovery in global automobile demand.

Impact on Nifty 50: Tata Motors is crucial for gauging consumer sentiment and the health of the automotive sector. Its strong performance provides a positive signal for the Nifty 50, given its expanding EV presence.

Stock Watch Insight: With robust EV demand, Tata Motors is positioned as a growth stock. Its future performance may hinge on EV adoption trends and any further recovery in global auto markets.

Key Sectors to Watch on Nifty 50

1. Banking and Financials

The banking sector, with major players like HDFC Bank, ICICI Bank, and State Bank of India, continues to show resilience in the face of inflationary pressures. Higher interest rates generally benefit banks’ NIM, and demand for credit remains robust across retail and corporate segments. Investors can look to this sector for steady growth and dividends.

For insights on the financial sector, read our article on India’s Banking Sector in 2024.

2. Information Technology

IT stocks like Infosys, TCS, and Wipro are under scrutiny due to lower global IT spending. However, long-term growth in cloud and digital services presents opportunities. Investors may want to focus on IT companies with strong digital service portfolios that can capitalize on demand in emerging tech areas.

3. Consumer Goods and FMCG

With inflation impacting consumer purchasing power, companies in the FMCG sector, such as Hindustan Unilever and ITC, have seen steady demand but tighter margins. This sector remains defensive in nature, offering stable returns, though price sensitivity is a factor to consider.

4. Automotive and EV

The automotive sector, particularly the EV segment, is experiencing rapid growth. Tata Motors leads this sector on Nifty 50, with an ambitious EV strategy to meet consumer demand. Companies with a focus on clean energy and EVs are likely to drive significant gains over the next several quarters.

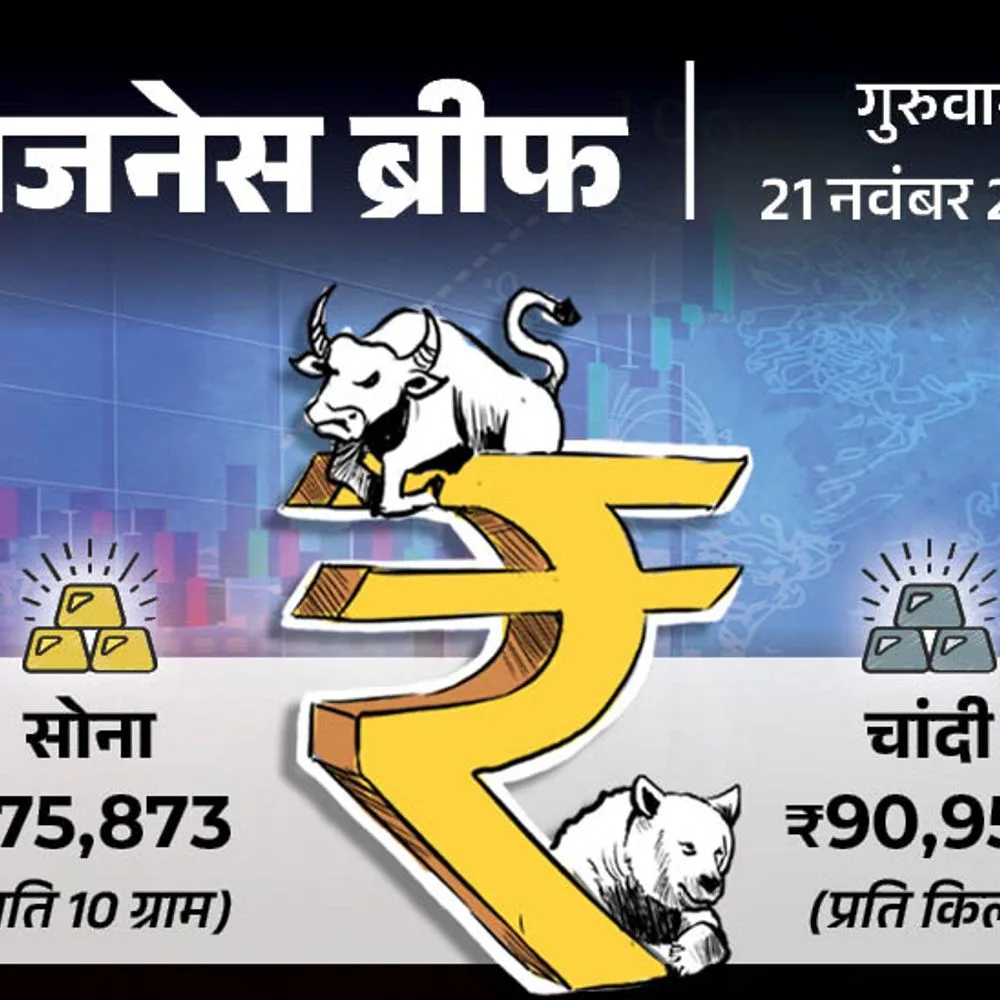

Economic Factors Impacting Nifty 50 Stocks

Several external factors continue to affect Nifty 50 stocks, including:

- Interest Rate Fluctuations: With the Reserve Bank of India (RBI) adjusting interest rates to curb inflation, sectors like banking and real estate may experience varying levels of impact on profitability.

- Global Economic Uncertainty: Geopolitical issues, currency volatility, and supply chain disruptions add to uncertainties, particularly for sectors reliant on exports like IT and pharmaceuticals.

- Consumer Demand and Inflation: Rising costs for essentials may affect disposable incomes, impacting sectors like FMCG and discretionary consumer goods.

For a comprehensive outlook on economic factors, check out our India’s Economic Forecast.

Conclusion: Stocks to Watch in the Next Quarter

Based on the latest quarterly results, here are the Nifty 50 stocks that merit attention:

- Reliance Industries for its diversified growth strategy across telecom, energy, and retail.

- HDFC Bank as a resilient performer in the banking sector with strong fundamentals.

- Infosys for its robust digital services portfolio, despite short-term global spending concerns.

- Tata Motors due to its leadership in the growing EV market and a strong recovery in global demand.

Each of these companies demonstrates resilience or growth potential in their respective sectors, making them valuable additions for investors seeking exposure to India’s dynamic economy.

For ongoing updates on Nifty 50 stocks and investment insights, visit our Investing and Market Insights Hub.

References and Further Reading:

- Reserve Bank of India – Economic and Financial Market Updates

- Ministry of Finance, India – Quarterly Reports and Economic Analysis