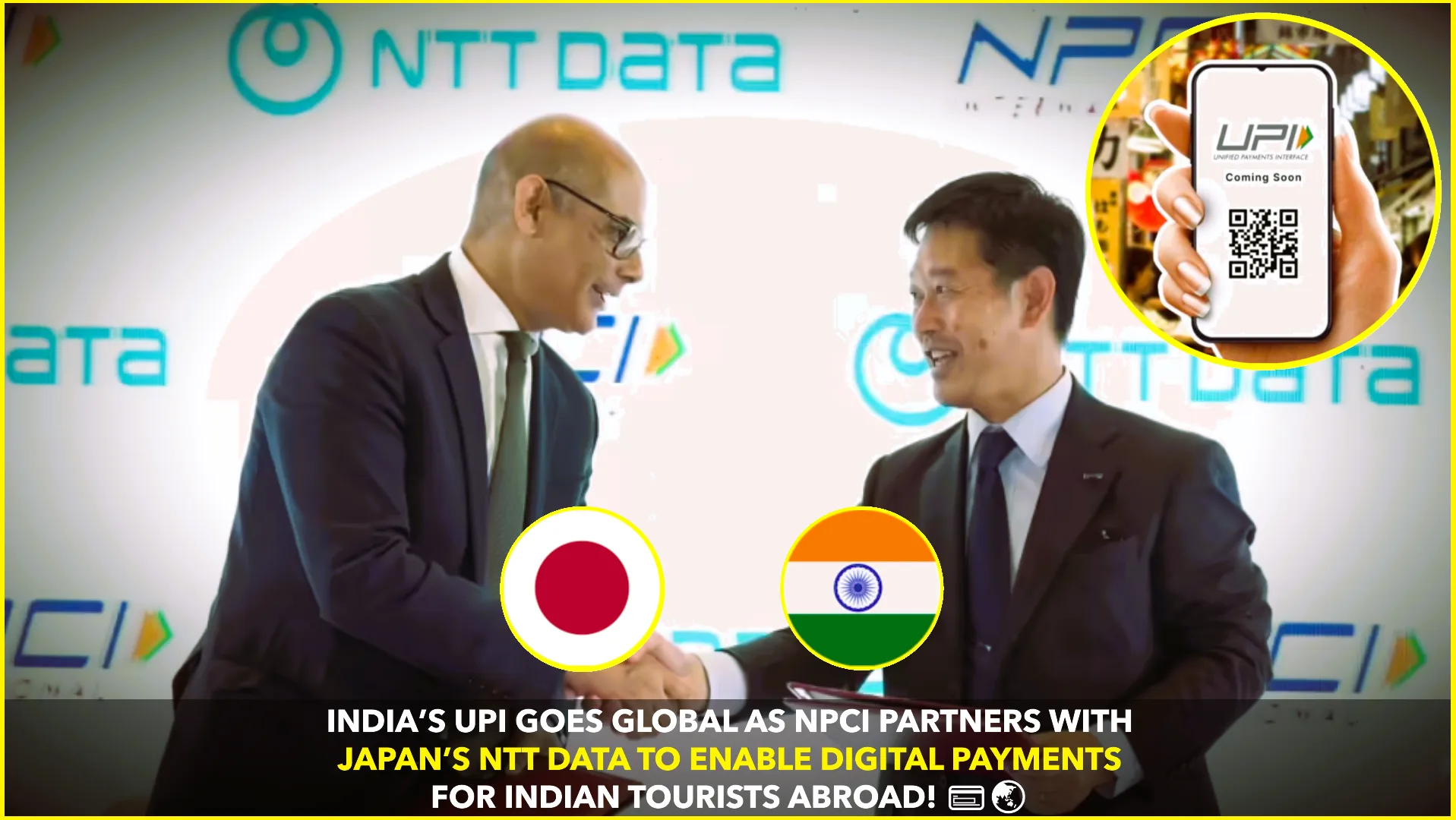

India’s homegrown digital payments system, the Unified Payments Interface (UPI), is set to make its debut in Japan — marking another major milestone in the global journey of Indian fintech.

The National Payments Corporation of India (NPCI), through its international arm NIPL (NPCI International Payments Limited), has signed a Memorandum of Understanding (MoU) with NTT Data Corporation, one of Japan’s leading IT and payment service providers, to introduce UPI-based payments in Japan.

(Source: NTT Data Official Press Release)

What the Deal Means

Once the integration is complete, Indian travelers visiting Japan will be able to pay at local merchants directly through their UPI-linked apps by scanning QR codes — just like they do back home.

The partnership will use NTT Data’s CAFIS payment network, one of Japan’s largest, to allow Japanese merchants to accept UPI payments securely and instantly. According to NPCI International, this collaboration aims to simplify cross-border transactions and make digital payments easier for the growing number of Indian tourists visiting Japan.

(Source: Times of India)

Strengthening India-Japan Digital Ties

The MoU also symbolizes strengthening digital cooperation between the two countries. Japan has been actively encouraging cashless payments as part of its “Cashless Vision” initiative, while India’s UPI model has emerged as a global success story.

NPCI International CEO Ritesh Shukla said, “Our goal is to expand the reach of UPI globally and make it a reliable and efficient payment option for Indian citizens wherever they go.”

(Source: Inc42)

Why Japan is an Important Step

Japan is a strategic choice for UPI’s international expansion. In recent years, the number of Indian tourists visiting Japan has grown rapidly, driven by business, education, and cultural exchange. Between January and August 2025, Indian visitor numbers increased by about 36 % year-on-year, according to Japan National Tourism Organization data cited by Indian media.

(Source: Times of India)

By offering UPI as a payment option, Japan hopes to make travel easier for Indian visitors while boosting spending at local merchants.

UPI’s Expanding Global Footprint

India’s UPI has already made inroads into several countries through partnerships — including Singapore, France, Nepal, Bhutan, Sri Lanka, and the UAE — where Indian travelers can use UPI or its linked apps for payments.

The addition of Japan marks a significant step in extending UPI’s reach to East Asia. With Japan being one of the world’s most technologically advanced nations, this partnership gives India’s payment technology a strong foothold in a major market.

(Source: NDTV Business)

What This Means for India’s Fintech Power

The UPI–NTT Data collaboration showcases India’s growing influence in global financial technology. Launched in 2016, UPI revolutionized domestic digital transactions, facilitating over 14 billion payments per month and becoming one of the fastest-growing payment ecosystems worldwide.

(Source: Reuters)

By exporting UPI to other countries, India is not only enhancing convenience for travelers but also positioning itself as a fintech exporter — providing digital infrastructure and expertise that other nations can adopt or integrate with.

Challenges Ahead

Despite the excitement, experts note that wide-scale implementation will take time. Regulatory alignment, merchant readiness, and real-time currency conversion will require coordination between NIPL, NTT Data, and Japanese banks. Still, both sides see this as a crucial first step toward deeper financial integration.

(Source: Business Standard)

A Step Toward a Cashless Global Future

If successfully implemented, the UPI–NTT Data initiative could pave the way for further UPI expansion into other East Asian markets. This aligns with India’s vision of promoting “Digital India, Global Impact”, where its technology solutions reach beyond national borders.

As UPI continues to grow, it reinforces India’s position as a leader in digital payments innovation — turning what began as a domestic success story into a global phenomenon.