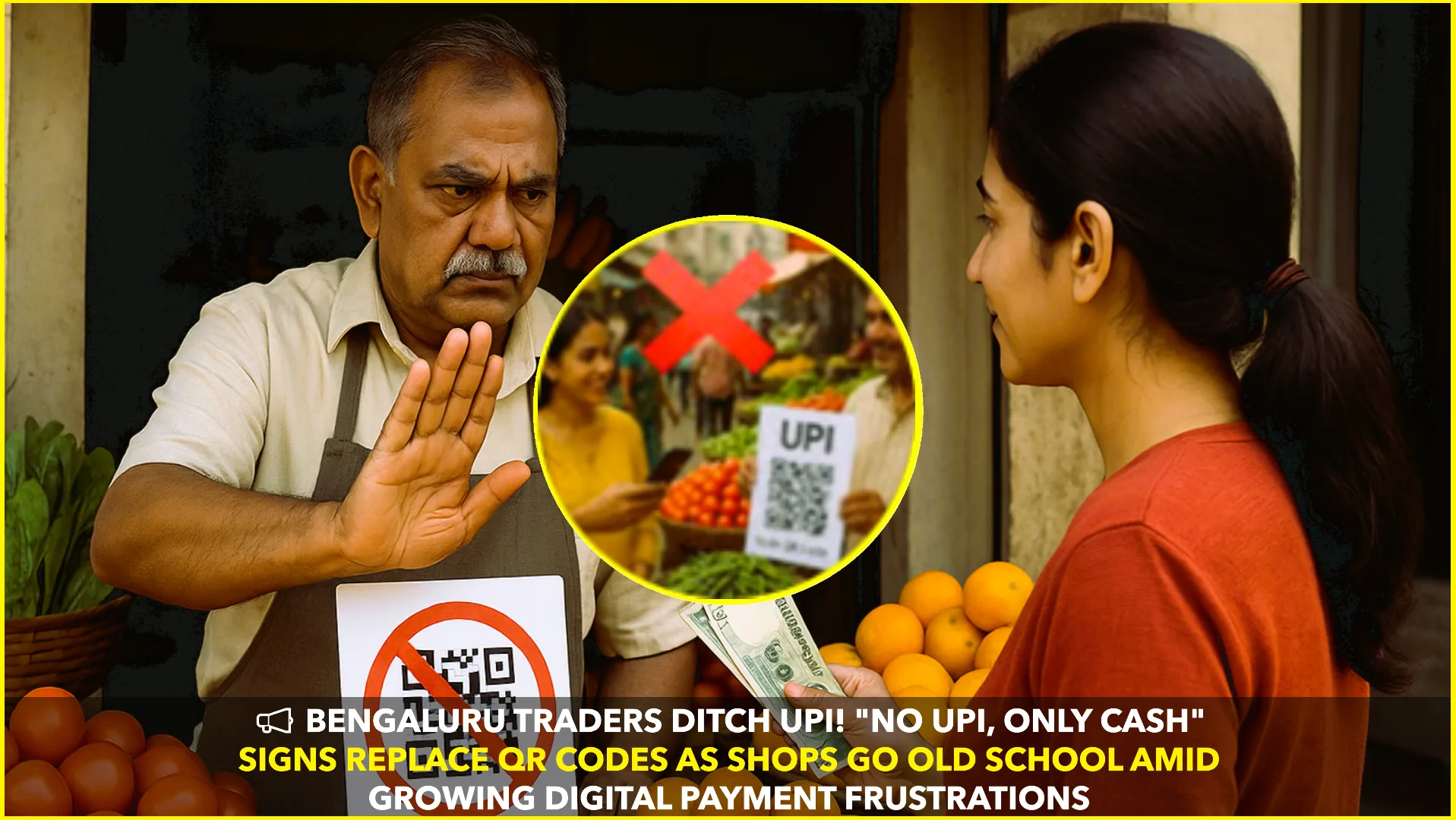

Bengaluru, July, 2025 — Once considered the poster city of India’s fintech revolution, Bengaluru is now experiencing a surprising shift in its payment landscape. Small vendors and even some mid-sized businesses are removing QR codes and displaying handwritten or printed signs that read, “No UPI, only cash.”

From tea stalls in Koramangala to grocery stores in Jayanagar, Bengaluru’s streets are increasingly showing a decline in the use of digital payments via UPI (Unified Payments Interface), a system that once made cash seem obsolete in India’s tech capital.

What’s Behind the Shift?

Shop owners cite a mix of technological fatigue, transaction delays, and mounting frustrations with payment settlement issues as primary reasons for this move.

“I lost ₹1,500 last week due to a ‘successful’ UPI payment that never came into my account,” said Naveen Kumar, a juice vendor near MG Road. “When customers say they’ve paid, we can’t argue. But later, it doesn’t reflect.”

Another concern is the cost of maintaining UPI-based transactions, especially for small businesses. Some merchants have raised alarms about bank charges, delay in settlements, and lack of immediate resolution to payment disputes.

According to reports by The Hindu and India Today Tech, several traders have been facing delays of up to 24–48 hours in receiving payments. “In a business with razor-thin margins, that delay can disrupt the entire cash flow cycle,” said Kavita Rao, who runs a local stationery store in Indiranagar.

Technical Glitches and Power Outages Add to Woes

The unreliability of internet connectivity is another key reason behind this regression. “When the signal drops or the server crashes, I lose sales,” complained Imran, who operates a small roadside biryani stall. “Cash is quick, no waiting, no errors.”

Digital illiteracy among older shopkeepers and support staff is also a barrier, especially in markets like KR Puram and Chickpet, where many prefer the familiarity of notes over screens.

Impact on Consumers

For many tech-savvy consumers, this cash-only trend is proving to be frustrating. “I barely carry cash,” said college student Shruti Desai. “This feels like a step backward in a city known for startups and IT.”

Experts Weigh In

Economists warn that such reversals can hamper India’s financial inclusion goals. “This trend may seem small, but if replicated across cities, it threatens the momentum gained over the last five years in digital payments,” said Rajeev Malik, a fintech analyst.

Digital payment platforms like PhonePe and Paytm have urged users to report failed transactions and have promised improved services. The National Payments Corporation of India (NPCI) has acknowledged occasional server overloads during peak hours and is working to upgrade systems.

What’s Next?

While Bengaluru’s cash comeback may seem like a temporary blip, it signals an important lesson: digital infrastructure must be as reliable and user-friendly as it is revolutionary.

For now, don’t be surprised if the next time you grab chai in Bengaluru, the sign reads “No Paytm, No GPay—Cash Only.”

Sources:

- [The Hindu – July 2025 Report on UPI Issues in Bengaluru]

- [India Today Tech – UPI Usage Decline Among Bengaluru Merchants]

- [NPCI Official Statements on Transaction Failures]