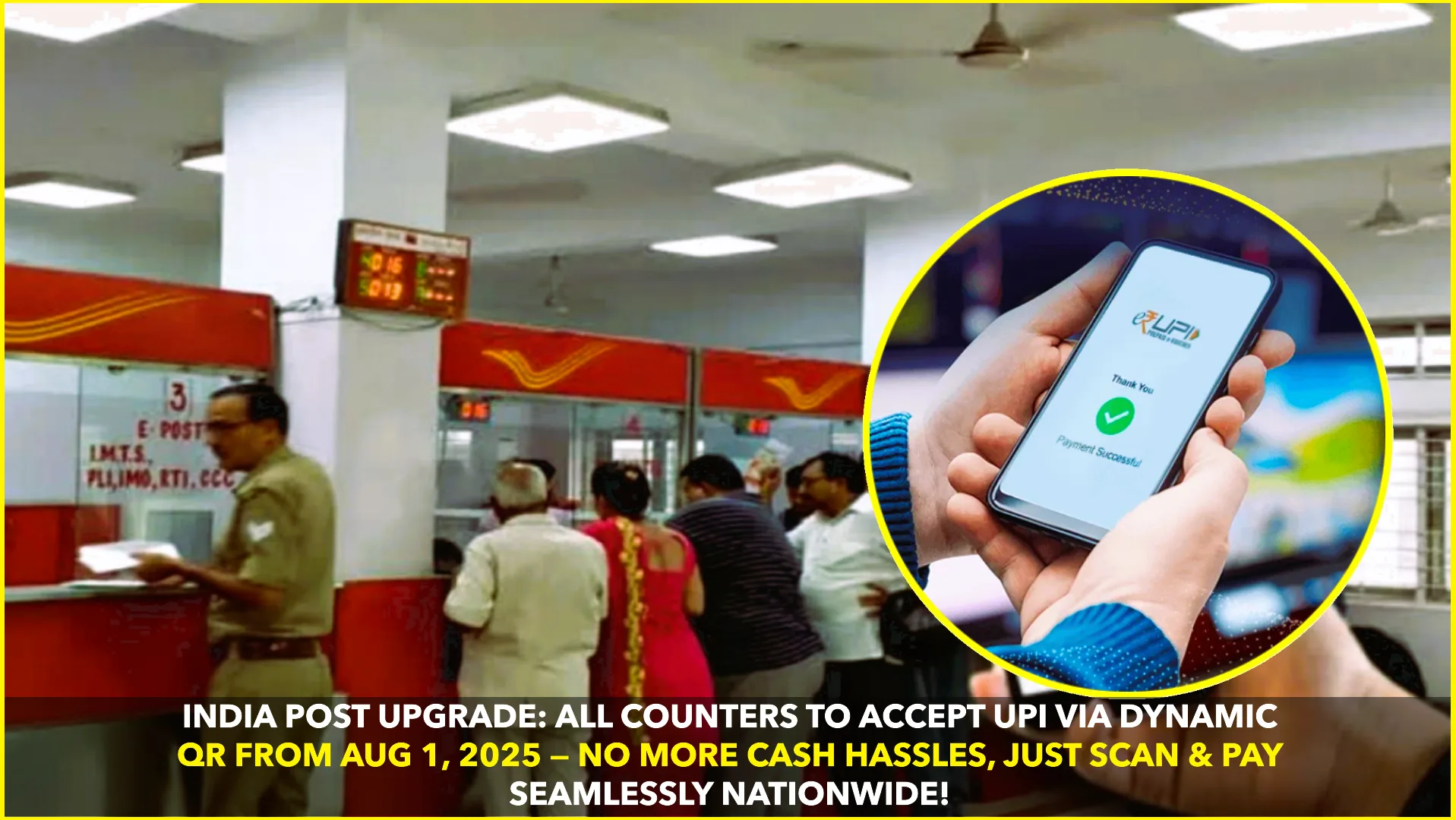

In a major step toward financial modernization, India Post announced that all its post office counters across the country will begin accepting UPI-based digital payments using dynamic QR codes from August 1, 2025. This move follows a successful pilot project conducted in Mysuru and Bagalkot, Karnataka, under the India Post’s IT 2.0 initiative.

This digital upgrade marks a shift from earlier static QR code payment systems, which had limitations in speed and transaction accuracy. By moving to dynamic QR codes, which generate a unique code for each transaction, India Post aims to overcome past technical challenges, enhance payment security, and improve transaction efficiency.

Boosting Digital Convenience at Post Offices

With over 1.55 lakh post offices in India — the world’s largest postal network — this initiative is expected to significantly increase the use of digital transactions among rural and urban customers alike. Citizens will now be able to scan the dynamic QR code at counters using any UPI-enabled app such as PhonePe, Google Pay, Paytm, BHIM, or others to make instant payments for postal, banking, and retail services.

“Dynamic QR codes will provide real-time and secure payment solutions, resolving earlier glitches related to transaction mismatch and delays,” a senior India Post official told The Hindu BusinessLine. “This move aligns with the government’s larger goal to strengthen digital public infrastructure and reduce dependence on cash, especially in rural and remote areas.”

A Successful Pilot Sets the Stage

The pilot programs conducted in Mysuru and Bagalkot received positive responses from customers and staff. The feedback highlighted faster transaction times, better reliability, and increased confidence in using digital methods over cash, especially for postal savings, bill payments, and parcel services.

According to officials, these trials were instrumental in ironing out technical and logistical challenges before the full-scale rollout. Now, equipped with improved infrastructure and trained personnel, India Post is ready for a nationwide deployment.

Part of India Post’s IT 2.0 Modernization Drive

The adoption of UPI dynamic QR payments is a component of the broader India Post IT 2.0 modernization program, which aims to transform post offices into multi-service digital hubs. This initiative includes upgraded hardware, software systems, cloud-based services, and better integration with India’s digital finance ecosystem.

The use of dynamic QR codes will also automatically link transactions to the respective services and receipts, helping reduce manual errors, enhance transparency, and improve audit trails.

Expanding Digital India

This strategic upgrade supports the Digital India vision, aiming to empower every citizen with access to modern financial tools. As post offices often serve as the first point of contact for banking and communication services in rural India, enabling UPI at counters will promote financial inclusion and digital literacy.

India’s UPI (Unified Payments Interface), developed by the National Payments Corporation of India (NPCI), has seen rapid adoption nationwide, crossing 10 billion monthly transactions in 2024. With India Post onboard, this number is expected to surge further as millions of customers embrace contactless payments in even the remotest parts of the country.

Looking Ahead

With the August 1 launch date nearing, India Post has begun training its staff and upgrading infrastructure across districts. Awareness campaigns are also planned to educate customers on using UPI safely and effectively.

This digital leap marks not just a convenience boost for customers but also a historic shift in the operational culture of India’s postal services — from paper and cash to real-time, secure, and seamless transactions.

Source: