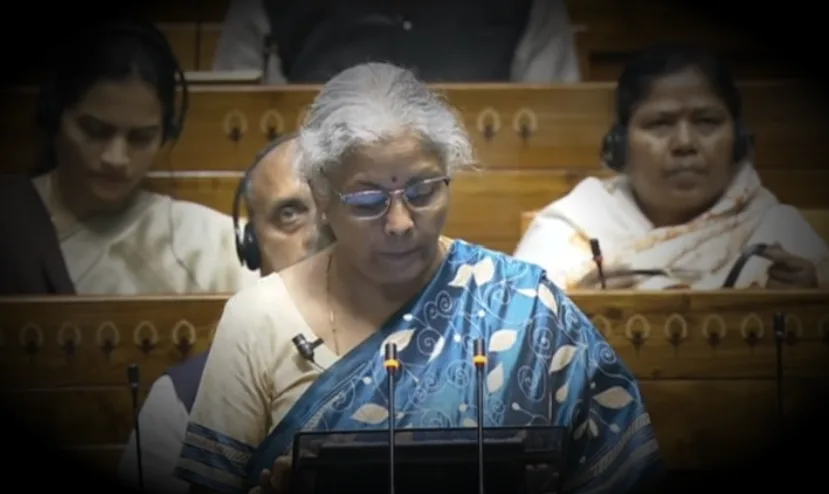

NEW DELHI: On Saturday, Finance Minister Nirmala Sitharaman delivered her eighth consecutive Union Budget, moving closer to the record held by former Prime Minister Morarji Desai, who presented ten budgets across multiple terms. Sitharaman is also the first woman to hold the full-time position of finance minister.

The Budget for the fiscal year 2025-26 marks the 14th consecutive budget under the Narendra Modi administration since 2014. Leading up to the announcement, there was keen interest in how the proposed measures would impact the cost of goods and services, particularly for the middle class. Here’s a breakdown of the key changes:

Items that became cheaper:

- Mobile Phones: 28 additional items used in mobile phone battery production were added to the list of exempted capital goods.

- Medicines: The Basic Customs Duty on 37 medicines was removed.

- Critical Drugs: 36 medicines used for treating cancer and rare diseases were also exempt from Basic Customs Duty.

- Raw Materials: Products such as cobalt, LED, zinc, lithium-ion battery scrap, and 12 critical minerals were fully exempted from Basic Customs Duty.

- Shipbuilding: The exemption on raw materials for shipbuilding was extended for another decade.

- Handicrafts: A new initiative was launched to boost handicraft exports.

- Leather: Wet blue leather was fully exempted from Basic Customs Duty.

Items that became more expensive:

- Interactive Flat Panel Displays: The Basic Customs Duty was raised from 10% to 20% to address the inverted duty structure.

In addition, the Economic Survey, presented in Parliament on Friday, forecasted India’s economic growth to be between 6.3% and 6.8% for FY2025-26. The survey highlighted the stability of India’s economic fundamentals, supported by a strong external account, fiscal discipline, and robust private consumption. The government’s focus on research and development (R&D), MSMEs, and capital goods is expected to foster long-term industrial growth.

“The fundamentals of the domestic economy remain robust, with a strong external account, calibrated fiscal consolidation, and stable private consumption. Based on these factors, we anticipate growth in FY26 to be between 6.3% and 6.8%,” the survey noted.

The survey also predicted a reduction in food inflation in the last quarter of FY25, driven by lower vegetable prices and the arrival of the Kharif harvest. A good Rabi harvest is expected to help keep food prices in check at the start of FY26. However, risks to inflation remain, including uncertain weather conditions and rising global agricultural prices.