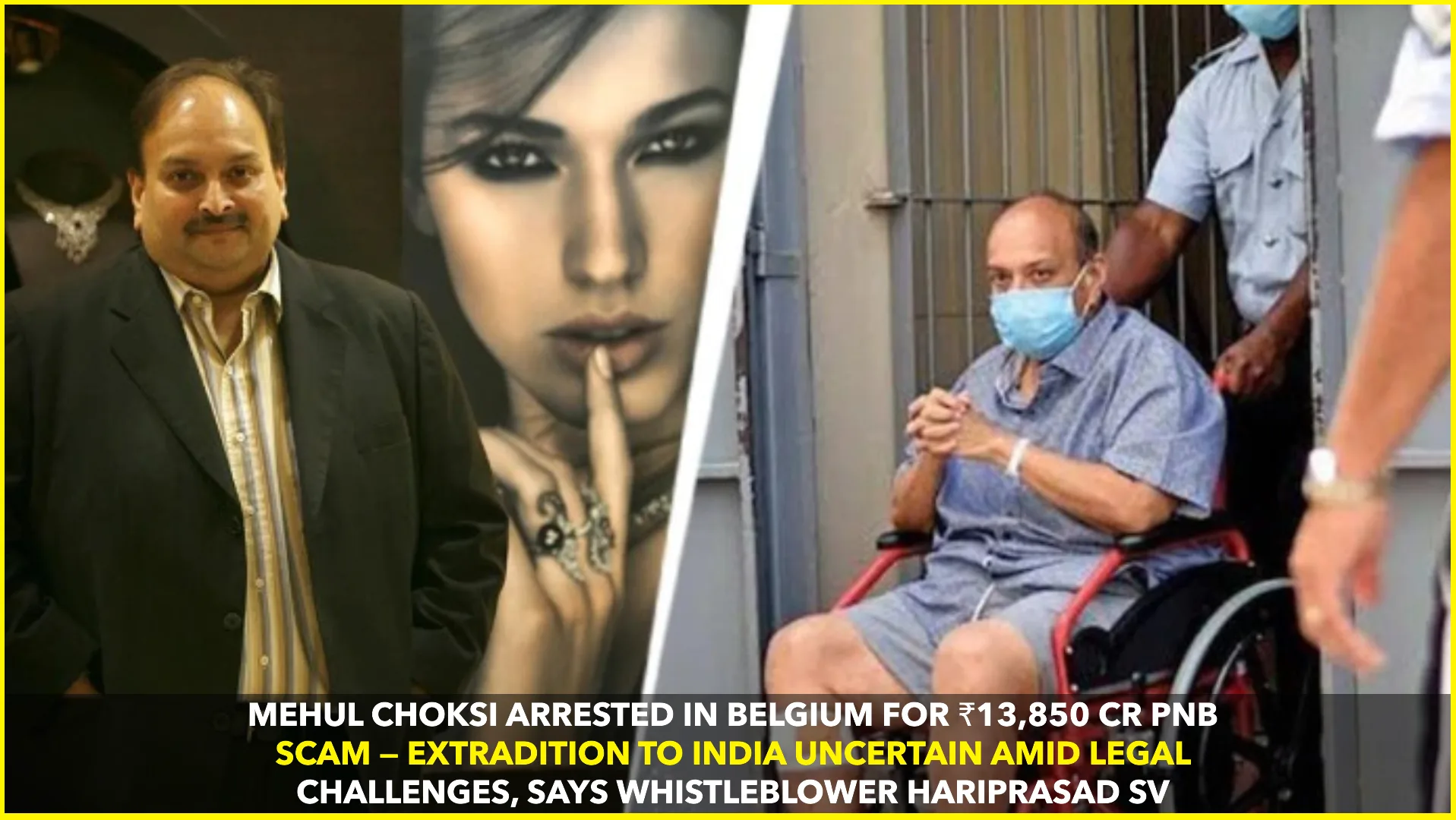

Brussels/New Delhi, April 13, 2025 — Mehul Choksi, one of the central figures in the ₹13,850 crore Punjab National Bank (PNB) scam, has been arrested in Belgium on April 12, 2025. The fugitive diamantaire, who fled India in 2018, was detained by Belgian authorities in coordination with Interpol, raising fresh hopes for justice in one of India’s biggest banking frauds. However, skepticism remains over whether his extradition to India will materialize anytime soon.

Choksi, the former chairman of Gitanjali Group, is accused of orchestrating a massive banking fraud along with his nephew Nirav Modi by fraudulently securing Letters of Undertaking (LoUs) from PNB to obtain credit from overseas banks. While Nirav Modi is fighting extradition in the UK, Choksi had been residing in Antigua and Barbuda, where he acquired citizenship under the country’s investment program.

In 2021, Choksi mysteriously disappeared from Antigua and was later found in Dominica under controversial circumstances. That episode further complicated extradition efforts and raised concerns about his ability to manipulate international legal loopholes.

Following his arrest in Belgium, Hariprasad SV, the whistleblower who brought the PNB scam to light, expressed both relief and concern. “This is definitely a significant development, but we must remain cautious,” he said in a media statement. “Choksi has consistently evaded justice, and with access to some of Europe’s best legal minds, there’s a high possibility that he could delay or derail extradition efforts once again.”

Hariprasad also pointed out that Choksi’s fraudulent activities extended beyond the PNB scam. “More than 100 franchise owners across India have filed complaints alleging that they were defrauded by him,” he added. These franchises, affiliated with the Gitanjali Group, have reportedly suffered huge financial losses, with cases pending in various courts across the country.

Legal experts say Choksi’s extradition from Belgium will depend on multiple factors, including the nature of charges filed against him, the documentation provided by Indian authorities, and compliance with Belgium’s legal and human rights frameworks. The process could take several months, if not years.

A senior official from India’s Central Bureau of Investigation (CBI), on condition of anonymity, confirmed that the agency is in touch with Belgian authorities through diplomatic channels. “We are preparing a watertight case for his extradition. All required legal documentation will be submitted promptly to ensure there are no procedural delays,” the official stated.

Meanwhile, the Ministry of External Affairs (MEA) is also expected to issue an official statement in the coming days. Sources indicate that diplomatic efforts are already underway to secure Choksi’s return to India, where he faces multiple charges including criminal conspiracy, cheating, money laundering, and corruption under the Prevention of Corruption Act and other relevant laws.

The PNB scam, first exposed in early 2018, shook the Indian banking sector and led to stricter regulations and oversight of public sector banks. It also triggered international investigations and increased scrutiny of fugitive economic offenders.

While Choksi’s arrest marks a critical moment in the case, legal hurdles remain formidable. Given his history of legal maneuvering and the complexity of international extradition treaties, the road to bringing him back to face trial in India may still be long and uncertain.

As India watches closely, the arrest rekindles hopes for justice but also highlights the continuing challenges in holding high-profile economic offenders accountable across borders.

Source: Based on verified information regarding Mehul Choksi’s arrest on April 12, 2025, and statements from PNB scam whistleblower Hariprasad SV.